**************************************************************************

By: Dr. Housing Bubble

12/1/11

With the Federal Reserve promising to bailout the entire world it is hard to grab any headlines away from that kind of action. In spite of putting the American taxpayer at risk for global debt issues especially when we have big enough problems at home we have now reached an all-time high with foreclosure inventories. That is correct, the shadow inventory is still enormous and the number of homes owned by banks is now at record levels. Of course this was all predictable like seeing a pig work its way through a python. The large bet that has failed was the belief that simply holding onto overpriced assets for two, three, and even four years would somehow allow home prices to catch up. The suspension of mark-to-market accounting and other shenanigans are now coming home to roost and home prices are making post-bubble lows. In other words, the day of reckoning for housing is already here. Don’t look now but foreclosure inventories are at record levels. What does this mean for housing going forward?

Foreclosure inventories at record levels

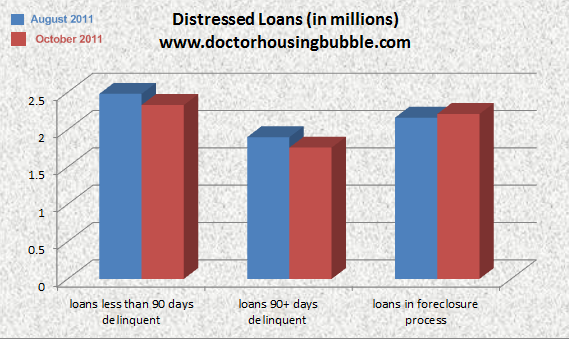

Foreclosure inventories are now at post-bubble records:

Total home listed as “foreclosed” has shot up to 2.21 million. The other two categories above show that there are still millions of other homes in the foreclosure pipeline. What this means is that for a few more years, we will have pricing pressure to the downside. Now most of the other two categories don’t even show up in MLS data since these are not completed foreclosures. But with five years of data it is very likely that these loans will go through the entire process and become REOs.

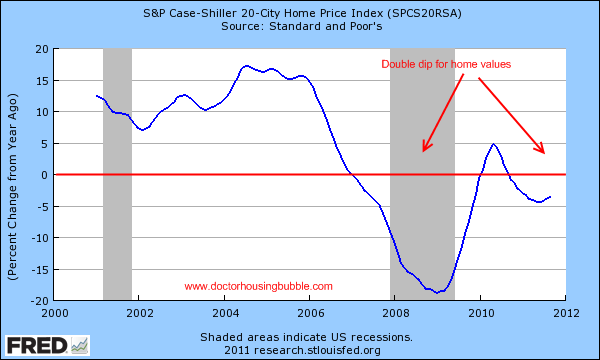

There is no debate that the housing market is now fully into a double-dip:

READ FULL STORY HERE

No comments:

Post a Comment