Mitt Romney's Tax Fraud

Imagine that you are completing your federal tax return. After looking up the tax rate for your income level, you decide you will pay 20 percent less to Uncle Sam. But along with your underpayment, you include a handwritten note to the IRS letting the government know that you promise to make up the difference at some future date by not claiming some deductions to which you are currently entitled. That, you tell the tax collector, makes your tax return "revenue neutral."

If you're like most Americans, your fraud will earn you a fine at best and prison time at worst. But if you're Mitt Romney, you believe that plan qualifies you to be President of the United States.

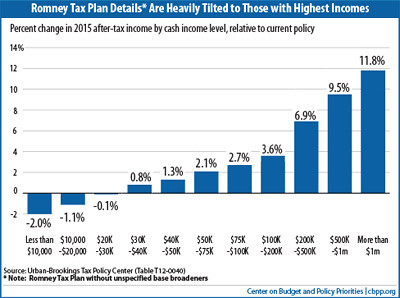

To understand how Romney's shell game works, a short primer is in order first. In essence, the GOP presidential nominee has proposed what might be called the "Bush-Dole" plan. Under a President Romney, that would make the budget-busting Bush tax cuts permanent, and then enact another 20 percent across-the-board reduction reminiscent of Bob Dole's failed 1996 scheme. As Matthew O'Brien summed it up in The Atlantic:

First, he extends all of the Bush tax cuts. Second, he cuts income tax rates an additional 20 percent. Third, he undoes the tax hikes and credits from Obamacare and the stimulus. Finally, he eliminates the capital gains tax for all but the richest households. The first three parts of this plan shower high-earners with most of the money. The last part is a bit of a fig leaf for the rest of us. After all, the top 0.1% of households earn half of all capital gains. Exempting middle-class households from this tax certainly helps them, but there's just not that much money there.(It's also worth noting that Romney wants to eliminate the inheritance income tax, a move which could theoretically divert over $80 million from the United State Treasury to his heirs.)

Unfortunately for a man who loves numbers, Mitt Romney's math simply doesn't work.

Not only does his safety-net shredding budget provide yet another massive tax cut windfall for the wealthy, the Romney plan produces red ink as far as the eye can see. The Tax Policy Center estimated Romney's tax cuts would cost Uncle Sam $460 billion in 2015 alone. (Combined with the extension of the Bush tax cuts, the total figure would reach $900 billion.) As ThinkProgress and the Washington Post's Lori Montgomery and Ezra Klein documented, Mitt Romney's risky new scheme makes George W. Bush look like Karl Marx:

Romney's claim that his plan would promote job and economic growth while reducing the deficit is also likely false. The Bush tax cuts were promoted under the same guise, only to blow a $2.5-trillion hole in the federal budget that was accompanied by worst performance of any post-war expansion" for growth in investment, GDP, and job creation. Romney's tax cuts are even more expensive, clocking in at a cost of more than $10.7 trillion over the next decade and reducing revenue to a paltry 15 percent of GDP, according to Linden. Balancing the budget on those terms, as Romney claims he will do, would be next to impossible.Impossible, that is, unless Mitt Romney eliminates some of the deductions for workers, families and businesses that cost Uncle Sam over $1 trillion a year. And so far, the cowardly Republican nominee has refused to say which ones he would cut.

No comments:

Post a Comment